In the last decade, technology has changed not only the way we buy things but also our experiences with the banks.

And if the digital industry created the environment where we can spend our money (the retail market has moved quickly), it’s only natural to expect big changes from the financial institutions as well.

The transition isn’t easy because the banking system worked just fine for a very long time (at least from their point of view).

You needed a loan? You went to the bank! You wanted to transfer some money? You went to the bank!

Basically, every interaction you had with your bank supposed a trip… yeah, to the bank.

The need to create new products

We have to understand that some resistance to the change is given by the fact that less interaction means fewer chances for the banks to convince us that we are in need of their products.

But here is where the change must take place. The consumer needs are the same, they just have to be communicated differently. And on others channels.

Steps that has to be made:

- Upgrade web and mobile technologies

- Create innovation and testing centers

- Adopt the habits and culture of digitally native companies

Potential rewards and losses

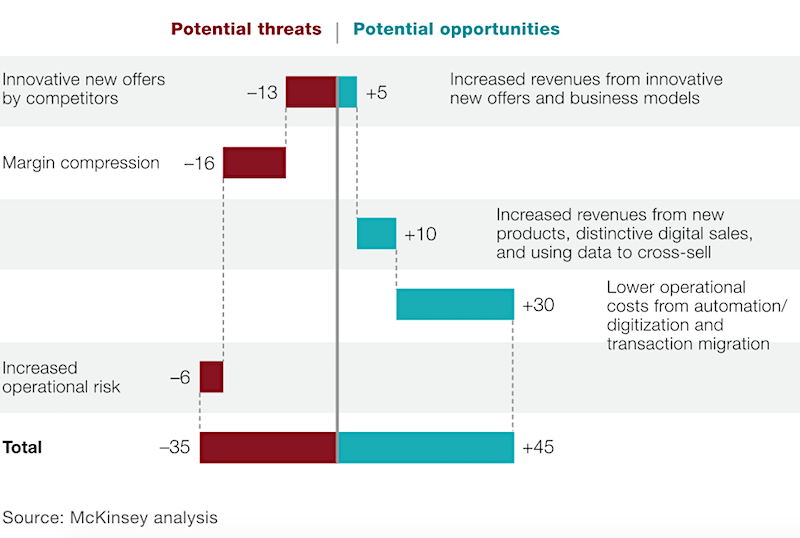

Below, you can see the impact from digital, % of net profit for retail bank. [source]

“By 2018, banks in Scandinavia, the United Kingdom, and Western Europe are forecast to have half or more of new inflow revenue in most products coming from digital sales”, according to a study published by Henk Broeders and Somesh Khanna for McKinsey.

For a better perspective about the situation today, worldwide and in the CEE region, don’t miss the discussions inside FinTech, a new content stream @ iCEE.fest 2017 (June 15&16).

Don’t miss the best price available and join the place to be for the CEE digital industry this June.